dsathyamurthie (6/26/2010 9:37:18 AM): sir no sir

dhanvarshagroup@ymail.com (6/26/2010 9:38:08 AM): mr shankar

Chandramouly Vidyashankkar (6/26/2010 9:38:39 AM): sir didint get into any trade sir

dhanvarshagroup@ymail.com (6/26/2010 9:38:53 AM): oho

Chandramouly Vidyashankkar (6/26/2010 9:38:56 AM): was not well. and couldnt stay long

dhanvarshagroup@ymail.com (6/26/2010 9:39:37 AM): have u booked loss on any trade ??

dhanvarshagroup@ymail.com (6/26/2010 9:40:24 AM): oh ..any health trouble

Chandramouly Vidyashankkar (6/26/2010 9:41:10 AM): yes sir fever,

Chandramouly Vidyashankkar (6/26/2010 9:41:21 AM): no sir no lose booking

dhanvarshagroup@ymail.com (6/26/2010 9:42:08 AM): thats why ... i noticede fewer activities from ursie

dhanvarshagroup@ymail.com (6/26/2010 9:42:20 AM): now is ok

Chandramouly Vidyashankkar (6/26/2010 9:42:30 AM): yes sir partially

dhanvarshagroup@ymail.com (6/26/2010 9:42:54 AM): please do care ...and take rest

Chandramouly Vidyashankkar (6/26/2010 9:43:04 AM): yes sir thanks,

dhanvarshagroup@ymail.com (6/26/2010 9:43:26 AM): what ever is going here ... i m updating at aangan

Chandramouly Vidyashankkar (6/26/2010 9:43:42 AM): yes sir, checking with it

dhanvarshagroup@ymail.com (6/26/2010 9:44:00 AM): so can be accessed any time

Chandramouly Vidyashankkar (6/26/2010 9:44:09 AM): yes sir

dhanvarshagroup@ymail.com (6/26/2010 9:44:30 AM): have u any suggestion for this...

dsathyamurthie (6/26/2010 9:45:12 AM): yes sir i wasnt able to take part for most of the time. It is helping a lot.

dhanvarshagroup@ymail.com (6/26/2010 9:46:37 AM): thats why dhanvarsha moderator suggested me to go for it

dsathyamurthie (6/26/2010 9:46:51 AM): ok sir

dhanvarshagroup@ymail.com (6/26/2010 9:48:29 AM): satya r u learning here

dsathyamurthie (6/26/2010 9:48:59 AM): sir a long way to go just started

dhanvarshagroup@ymail.com (6/26/2010 9:49:21 AM): true but have u stepped on na

dsathyamurthie (6/26/2010 9:49:56 AM): yes

dsathyamurthie (6/26/2010 9:50:14 AM): just started to see charts a little

dhanvarshagroup@ymail.com (6/26/2010 9:50:52 AM): ok will u please share your views on moving averages

dsathyamurthie (6/26/2010 9:52:34 AM): Moving averages help us in predicting the direction and momentum of the the trend to some extent

dsathyamurthie (6/26/2010 9:54:32 AM): SMA(Simple Moving Average), WMA(Weighted Moving Average), EMA(Exponentioal Moving Averages ) are some moving averages used

dsathyamurthie (6/26/2010 9:55:30 AM): SMA -Simple Average of Prices (mostly Closing Price)

dhanvarshagroup@ymail.com (6/26/2010 9:56:22 AM): see describe in detail feeling that we dont know what is moving average... so u get refreshed and all our group will be benefiited n after uploading on net we all will be viewed by whole world...after 1000 yrs too

dsathyamurthie (6/26/2010 9:56:47 AM): EMA-Gives more weightage to the latest price and seems to be better

dhanvarshagroup@ymail.com (6/26/2010 9:57:07 AM): and wma

dsathyamurthie (6/26/2010 9:57:19 AM): yes just a min

mahendra tanwar (6/26/2010 9:58:34 AM): good morning sie

mahendra tanwar (6/26/2010 9:58:39 AM): sir

dhanvarshagroup@ymail.com (6/26/2010 9:59:03 AM): hi gm mahendra

dsathyamurthie (6/26/2010 9:59:11 AM): sir will start with SMA again

dhanvarshagroup@ymail.com (6/26/2010 9:59:48 AM): dsathyamurthie: Moving averages help us in predicting the direction and momentum of the the trend to some extent dsathyamurthie: SMA(Simple Moving Average), WMA(Weighted Moving Average), EMA(Exponentioal Moving Averages ) are some moving averages used dsathyamurthie: SMA -Simple Average of Prices (mostly Closing Price)

dsathyamurthie (6/26/2010 10:00:01 AM): SMA for a period of 20 days will mean just the mean of the previous 20 days data

dhanvarshagroup@ymail.com (6/26/2010 10:00:25 AM): what data ??

dsathyamurthie (6/26/2010 10:00:46 AM): SMA= (Price 1st Day +Price 2nd Day +...Price 20 th day) / 20

dsathyamurthie (6/26/2010 10:01:29 AM): SMA mostly are calculated on closing price Basis

dhanvarshagroup@ymail.com (6/26/2010 10:01:30 AM): sma means

dsathyamurthie (6/26/2010 10:01:44 AM): SMA-Simple Moving Average

dhanvarshagroup@ymail.com (6/26/2010 10:02:31 AM): so how the mas help in price prediction

dsathyamurthie (6/26/2010 10:03:06 AM): SMA can be calculated even on minitue, Hourly, Weekly or based on different periods

Moving Averages,

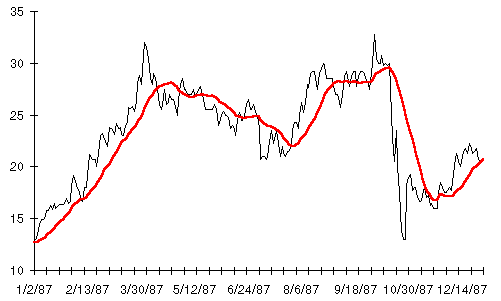

In technical analysis, moving averages are used to smooth out short-term price fluctuations and show the direction of the trend; moving averages are amongst the oldest technical indicators and, in my opinion, one of the best. Moving averages are lagging indicators that pay attention to price direction only; they reveal a trend after it has been in place for sometime. The two most common types of moving averages used in technical analysis are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). A Simple Moving Average is the average (or mean) value of a certain number of data points. For example, a 3-day SMA would be today’s price + yesterday’s price + the day before yesterdays price divided by 3. An Exponential Moving Average is similar to the Simple Moving Average, the only difference being that it applies a weighting factor (which decreases exponentially) to the data; for example, a 3-day EMA would still be composed of today’s price, yesterday’s price and the day before yesterdays price, but today’s price would carry the most weight and the last day’s price would carry the least. The formula used for calculating the EMA’s weighting factor is 2/(EMA period+1). Moving averages are typically applied to the bar (or candles) closing values, however they can be applied to the bar's highs, lows, or anything else.Moving averages don't predict future price movements; rather, they simply show what has already happened and reveal the trend's direction. Trading systems that use moving averages are usually trend following in nature. The idea behind these systems is usually to catch a trend after it has begun and ride it until it has finished. These systems only work well when the market is trending. In choppy sideways moving markets these systems usually result in a string of losses as any minor trend probably won't last long enough to make a big enough profit to make up for the pips that are given back when the trend reverses as the trend reversal will have to be well under way before the moving averages will detect it.

dsathyamurthie (6/26/2010 10:03:40 AM): so how does it help in predicting the Price movement?

dsathyamurthie (6/26/2010 10:05:26 AM): If the Price is above the SMA value we can infer that the trend is bullish on basis of the period we use

dhanvarshagroup@ymail.com (6/26/2010 10:05:31 AM): ye who is planning to answer it ...

dsathyamurthie (6/26/2010 10:07:55 AM): Sir should i elobarate more

dhanvarshagroup@ymail.com (6/26/2010 10:09:02 AM): ask others too ....r they interested ... i m interested in ur guidance ...

dsathyamurthie (6/26/2010 10:10:08 AM): sir i think most will be knowing the basics trouble comes only in using it to our advantage

dhanvarshagroup@ymail.com (6/26/2010 10:11:42 AM): see we r puttingthis forall who even never heard about mas .....

dsathyamurthie (6/26/2010 10:12:01 AM): ok sir

dhanvarshagroup@ymail.com (6/26/2010 10:12:27 AM): what do u feel mr shankar n mahender

dhanvarshagroup@ymail.com (6/26/2010 10:13:36 AM): see lover is 57.50

dsathyamurthie (6/26/2010 10:18:34 AM): sir

dhanvarshagroup@ymail.com (6/26/2010 10:20:34 AM): yes

dsathyamurthie (6/26/2010 10:21:18 AM): Sir will make a write up on MA and then send it to u

dhanvarshagroup@ymail.com (6/26/2010 10:21:27 AM): oho

dhanvarshagroup@ymail.com (6/26/2010 10:21:52 AM): i have lot of books and material on ma

dhanvarshagroup@ymail.com (6/26/2010 10:22:40 AM): and can write for 5 hrs on mas

dsathyamurthie (6/26/2010 10:22:50 AM): sir its not for that i couldnt come up immediately in a simple manner

dhanvarshagroup@ymail.com (6/26/2010 10:25:04 AM): ok

dhanvarshagroup@ymail.com (6/26/2010 10:25:28 AM): thats why i started like group discussion

dsathyamurthie (6/26/2010 10:26:02 AM): My understanding on MA is

dsathyamurthie (6/26/2010 10:26:17 AM): 1. It is a lagging indicator

dhanvarshagroup@ymail.com (6/26/2010 10:26:29 AM): ok

dsathyamurthie (6/26/2010 10:26:57 AM): 2. When a short period moving avarage is above a medium and long period ma the trend is up

dhanvarshagroup@ymail.com (6/26/2010 10:27:25 AM): true

dsathyamurthie (6/26/2010 10:27:45 AM): Eg considering 20, 50 and 100 Period MA

dsathyamurthie (6/26/2010 10:29:05 AM): If the Price is above the 20 period Ma it is bullish in short term and above 50 Bullish in medium Term and simillarly for 100 period bullish in longterm period

dhanvarshagroup@ymail.com (6/26/2010 10:30:02 AM): ok

dsathyamurthie (6/26/2010 10:30:21 AM): Most often we use EMA's as SMA gives equal importance to all the values be it old or latest data

dhanvarshagroup@ymail.com (6/26/2010 10:30:35 AM): ok

dhanvarshagroup@ymail.com (6/26/2010 10:31:10 AM): we will place premkt order ar 5318.85

dsathyamurthie (6/26/2010 10:31:17 AM): EMA's gives more weightage to the recent values and the weightage decreases exponentially for older values

dsathyamurthie (6/26/2010 10:32:07 AM): sir 5318 is it sell order u are saying

dsathyamurthie (6/26/2010 10:32:35 AM): is it for the longs taken yesterday ?

dhanvarshagroup@ymail.com (6/26/2010 10:33:02 AM): ya pre mkt

dhanvarshagroup@ymail.com (6/26/2010 10:33:25 AM): will ammend if not executed

dsathyamurthie (6/26/2010 10:33:26 AM): One more trading Practice based on Ma is MA Crossover.

dhanvarshagroup@ymail.com (6/26/2010 10:33:38 AM): ya

dhanvarshagroup@ymail.com (6/26/2010 10:33:42 AM): k

dhanvarshagroup@ymail.com (6/26/2010 10:33:59 AM): who all r here ??

dsathyamurthie (6/26/2010 10:34:14 AM): When a short term MA crosses a Medium Term or long Term Ma from below it is traeted as a Bullish crossover

dsathyamurthie (6/26/2010 10:34:44 AM): Eg a 20 day MA crossing 50 Day MA is bullish

dsathyamurthie (6/26/2010 10:34:52 AM): from Below

dsathyamurthie (6/26/2010 10:35:24 AM): and a 20 day Ma crossing a 50 Day Ma from aboce is Bearish

dsathyamurthie (6/26/2010 10:37:52 AM): Sir that is my understanding on MA

dhanvarshagroup@ymail.com (6/26/2010 10:41:51 AM): gud grip on subject

dhanvarshagroup@ymail.com (6/26/2010 10:42:01 AM): mahender

dsathyamurthie (6/26/2010 10:42:02 AM): Thanks sir

dhanvarshagroup@ymail.com (6/26/2010 10:42:30 AM): tanwar or mr shankarBookmark

No comments:

Post a Comment